Namely Recommended: Payroll Processing Validation Best Practices

This article provides tips on the best reports to use to validate your payroll (during Step 3 of the payroll process) before submitting and advises on some post-processing reports we recommend downloading.

OVERVIEW

Namely has a number of reports available in Namely Payroll that we recommend running each time payroll is processed. Running these reports and auditing your payroll data will help reduce errors which will limit the need for voids and reissues, retractions, amendments and W2-Cs.

STEP 3 REPORTS

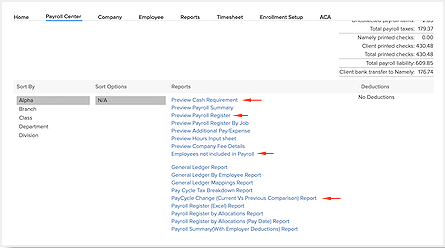

A number of in-cycle reports are provided in Step 3 of payroll, which are designed to help you review and audit your pay cycle data to ensure your payroll is processed as expected. These reports are available at the bottom of your browser in Step 3 of payroll.

While all of the reports available are valuable and provide different views of your payroll data, we recommend reviewing the following reports prior to clicking Approve Pay Cycle to perform a high-level audit of your data.

Preview Cash Requirement

Use this report to validate:

-

The total payroll liability - i.e., that you have the required amount of funds in your bank account to cover the payroll.

-

Any paper checks that you will be cutting in house (for anyone not receiving direct deposit.)

-

Common items to review: Expected totals for all earnings, taxes, and deductions.

Preview Payroll Register

Use this report to validate:

-

The expected totals for all earnings, taxes and deductions.

-

Common items to review: Individual employee's earnings, taxes, deductions. This report will provide by-employee snapshots similar to pay stubs.

Employees not included in Payroll

This report notes which employees are not included in a pay cycle run. This is good to review to make sure everyone is getting paid. Use this report to validate that you don't have employees who will not be receiving a check, but should be.

PayCycle Change (Current v. Previous Comparison) Report

Use this report to validate any changes made to an employee profile since the last pay date:

-

Banking information

-

Salary amounts

-

Deduction amounts

-

Notes

-

This report will only be available after you have run at least one payroll (as it does a comparison to the previous payroll).

-

This report is only available for Standard Pay Cycles (not Manual Pay Cycles.)

-

Employee Pay Stubs

We recommend reviewing each employee's pay stub to ensure accuracy. You can review individual pay stubs by clicking on the employee's name on Step 3.

POST-PROCESSING REPORTS TO DOWNLOAD

Once payroll has been approved, Namely recommends downloading a number of reports for your records, which will be helpful for any future payroll auditing you may perform. The following reports can be found in Namely Payroll > Reports > Pay Cycle:

-

Final copies of the first four reports mentioned above. Namely generates new in-cycle reports each time you click Calculate at the end of Step 2. Once you click Approve Pay Cycle in Step 3, a final version of the reports will be available in Pay Cycle reports.

-

Deductions by Employee and Pay Date - This is helpful to have on hand to keep track of employee deduction amounts and for later deduction audits.

-

General Ledger Report

-

Note: the General Ledger Report will only function if you use our General Ledger feature, which requires mapping earning codes, deduction codes, and taxes to account numbers. For more details, read Configuring a General Ledger.

-

AUDITING BEST PRACTICES

-

Review company totals and employee-level numbers for all data (wages, taxes, deductions) entered into the payroll.

-

Confirm that your employee roster is correct- i.e., that new employees and terminated employees are being paid (or not paid) appropriately.

-

If auditing reveals any changes that need to be made prior to your payroll due date, you can Roll Back (i.e., unapprove) your payroll until 4PM on your due date. If you have rolled back your payroll, you will still need to re-submit your payroll by the deadline (5PM ET.)